Guidewire ClaimCenter is a comprehensive claims management system widely used in the insurance industry. As a business analyst, understanding the intricacies of Guidewire ClaimCenter and acquiring the skills to gather accurate and detailed requirements is vital for successful implementations. In this article, we will delve into the importance of training in Guidewire ClaimCenter business analysis, focusing specifically on requirement gathering.

The Role of a Business Analyst in ClaimCenter Implementations: Business analysts play a critical role in the implementation of Guidewire ClaimCenter. They act as a bridge between business stakeholders and technical teams, ensuring that business requirements are accurately captured and translated into effective solutions. Training in ClaimCenter business analysis equips professionals with the necessary knowledge and techniques to excel in their roles.

Requirement Gathering Techniques for ClaimCenter: Effective requirement gathering is the cornerstone of a successful ClaimCenter implementation. Business analysts need to employ various techniques to elicit and document requirements. Some essential techniques for requirement gathering in the context of ClaimCenter include:

a. Stakeholder Interviews: Conducting interviews with business stakeholders, including claims adjusters, supervisors, and managers, helps gather insights about their needs, pain points, and expectations from the system.

b. Workshops and Focus Groups: Organizing workshops and focus groups enables business analysts to gather requirements from multiple stakeholders simultaneously, fostering collaboration and consensus.

c. Document Analysis: Analyzing existing business documents such as policies, procedures, and forms helps identify key requirements and potential gaps or areas for improvement.

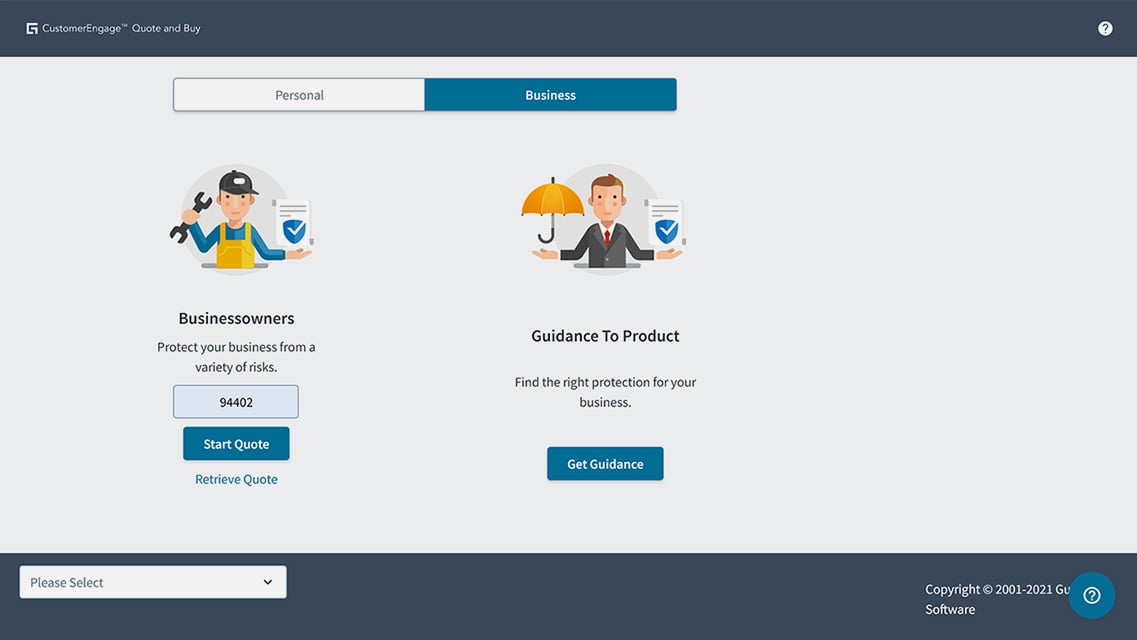

d. Prototyping and Mockups: Creating visual representations of the proposed system using prototypes and mockups facilitates clear communication with stakeholders and helps validate requirements.

e. User Story Mapping: Adopting Agile methodologies, such as user story mapping, allows business analysts to break down requirements into manageable user stories, prioritizing features and defining user interactions.

Understanding ClaimCenter's Functional Capabilities: To effectively gather requirements for ClaimCenter, business analysts need a deep understanding of the system's functional capabilities. Training should cover topics such as:

a. Claims Lifecycle: Familiarity with the end-to-end claims lifecycle in ClaimCenter is crucial for capturing requirements related to claim intake, triage, investigation, payment, and resolution.

b. Workflow and Automation: Understanding the configurable workflows and automation capabilities of ClaimCenter helps identify opportunities for streamlining and optimizing claim processes.

c. Integration Points: Knowledge of ClaimCenter's integration capabilities allows business analysts to identify requirements for seamless integration with other systems, such as policy administration or financial systems.

d. Reporting and Analytics: Familiarity with ClaimCenter's reporting and analytics features enables business analysts to gather requirements for generating insightful reports and dashboards that meet the needs of various stakeholders.

Communication and Documentation: Training in effective communication and documentation is crucial for business analysts working with ClaimCenter. They need to capture requirements accurately and communicate them clearly to technical teams. Training should cover techniques for creating requirement documents, use cases, user stories, and acceptance criteria, ensuring a shared understanding among stakeholders.

Training in Guidewire ClaimCenter business analysis, with a focus on requirement gathering, equips professionals with the necessary skills to gather accurate and comprehensive requirements for successful ClaimCenter implementations. By employing various techniques, understanding ClaimCenter's functional capabilities, and honing communication and documentation skills, business analysts can ensure that the implemented system aligns with the needs and expectations of the organization. With proper training, business analysts become invaluable contributors to the successful deployment and optimization of Guidewire ClaimCenter within insurance companies.

Write a public review