Guidewire Claim Center Functional Course for Quality Analyst.

Gain expertise in the functional aspects of claims management, covering end-to-end processes, stakeholder collaboration, and system optimization for seamless insurance claims handling.

Gain expertise in the functional aspects of claims management, covering end-to-end processes, stakeholder collaboration, and system optimization for seamless insurance claims handling.

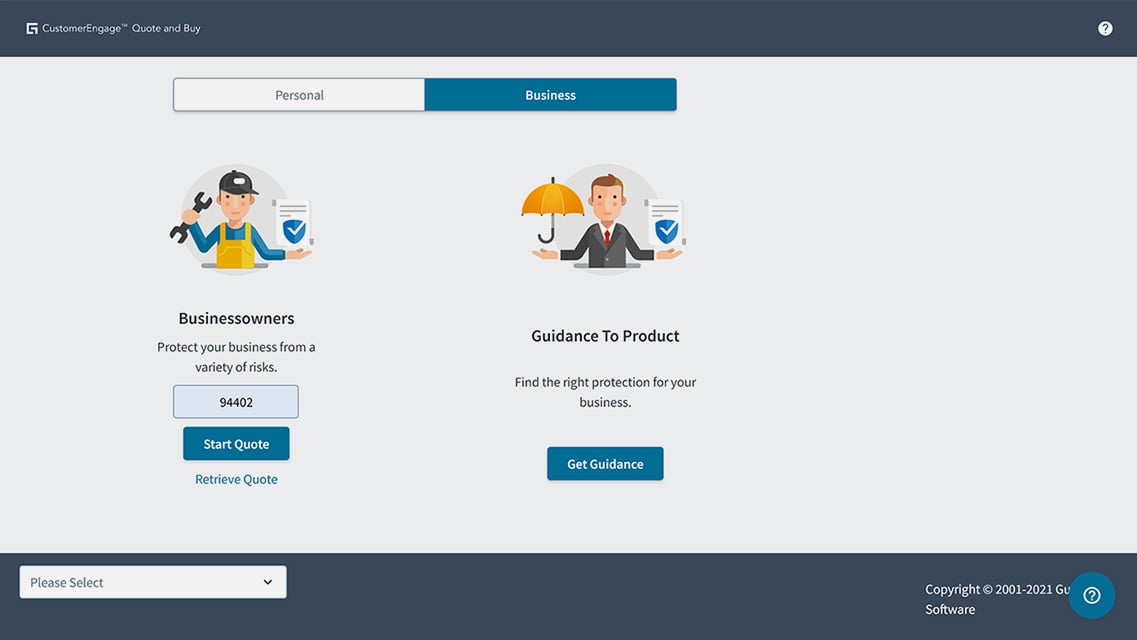

A policy management system to analyze performance, update product models, and iterate in real-time with modern workflows and functionality that maximize profitability and ensure your successful greenfield products can scale efficiently.

Put your customers at the center of every interaction with personalized, proactive experiences that match them to the right lines of business, at the right price, and at the right moment.

A policy management system to analyze performance, update product models, and iterate in real-time with modern workflows and functionality that maximize profitability and ensure your successful greenfield products can scale efficiently.

The Claim Center Functional Course for Quality Analysts is designed to equip QA professionals with specialized skills in testing and ensuring the quality of Guidewire ClaimCenter, a prominent platform for insurance claims management. This detailed course covers the following key aspects: Insurance Claims Processes Understanding: In-depth exploration of the end-to-end insurance claims processes, from First Notice of Loss (FNOL) to settlement, enabling QAs to align testing strategies with real-world scenarios.

Test Case Design and Execution: Comprehensive training on designing effective test cases that encompass various claims processing scenarios. QAs learn to execute tests to validate data accuracy, system responses, and workflow functionality.

Guidewire ClaimCenter Configuration Insights: Understanding how Guidewire ClaimCenter is configured to meet specific business requirements. This knowledge empowers QAs to identify critical areas for testing and ensures a thorough grasp of system behavior.

Regulatory Compliance Testing: Exploration of regulatory compliance considerations within the insurance industry, enabling QAs to design tests that verify adherence to industry regulations and standards.

Collaboration with Business Analysts: Emphasis on effective collaboration with business analysts for clear communication of requirements and accurate test case creation. QAs learn to bridge the gap between technical aspects and business needs.

Defect Identification and Reporting: Training on identifying and reporting defects efficiently, ensuring clear communication to developers for prompt resolution. QAs acquire skills in documenting issues with precision.

Risk-Based Testing Strategies: Insights into risk-based testing approaches, allowing QAs to prioritize testing efforts based on the criticality of specific areas in the claims system.

ClaimCenter Functionality Validation: Practical exercises and case studies that enable QAs to validate the functionality of Guidewire ClaimCenter. This includes verifying system responses, data accuracy, and overall user experience.

Test Automation Opportunities: Depending on the course, QAs may learn about test automation within the Guidewire ClaimCenter environment, enhancing efficiency and coverage for repetitive and critical test scenarios.

Real-world Application: Practical application of learned concepts to real-world scenarios commonly encountered in claims processing. QAs gain hands-on experience to strengthen their problem-solving skills.

As the P&C insurance industry's most trusted insurance policy administration system, PolicyCenter provides an unrivaled digital toolbox to deliver a comprehensive product experience.

Customers in 20 countries. PolicyCenter equips you to meet the ever-evolving demands of your business, your customers, and the P&C insurance industry at scale.

or more of Guidewire's product revenue is invested in R&D — and our 700+ R&D team is the largest in the industry. We're constantly evolving our platform to meet your needs.

Professionals and more than 800 consultants from our Consulting partners provide scale and choice, supporting P&C insurance companies and their customers.

Jerome Guionnet

Write a public review