This Guidewire Policy Centre course offers an in-depth overview of Policy Centre topics including Policy Centre Configuration and Integration, covering all aspects of Policy Centre Data Model, PC System Configuration, Rating Engine and more... The online course covers all aspects of real time work on Policy Centre application with PC specific code changes, config updates, business rules changes, Integration with third party application and more.

Guidewire PolicyCenter certification training course includes below:

Course Introduction: An overview of the certification program, the training objectives, and the structure of the course.

PolicyCenter Overview: A detailed introduction to Guidewire PolicyCenter, its features, architecture, and the role it plays in insurance policy administration.

PolicyCenter Configuration: Hands-on training on configuring PolicyCenter to meet specific business requirements. This may include setting up lines of business, products, rules, workflows, and user roles.

PolicyCenter Integration: Instruction on integrating PolicyCenter with other systems such as billing, claims, and external data sources. This may involve learning about integration patterns, web services, and data mapping.

PolicyCenter Functionality: In-depth training on various PolicyCenter functionalities, including policy quoting, underwriting, rating, endorsements, renewals, cancellations, and endorsements.

PolicyCenter Customization: Guidance on extending PolicyCenter's capabilities through customizations. This may cover topics like creating custom screens, data model extensions, and business rules.

PolicyCenter Testing and Troubleshooting: Techniques for testing PolicyCenter configurations, workflows, and integrations. Instruction on troubleshooting common issues and resolving them effectively.

Certification Exam Preparation: Review of the key concepts covered in the course and practice exams to help you prepare for the certification exam.

Certification Exam: A final exam to assess your understanding of PolicyCenter and determine your eligibility for certification.

Training Components:

Training programs for Guidewire Policy Center typically cover the following key components:

Policy Configuration:

- Understanding and configuring insurance products.

- Defining rules and underwriting guidelines.

Integration:

- Integration with other Guidewire components like Claim Center and Billing Center.

- Connecting with external systems and third-party services.

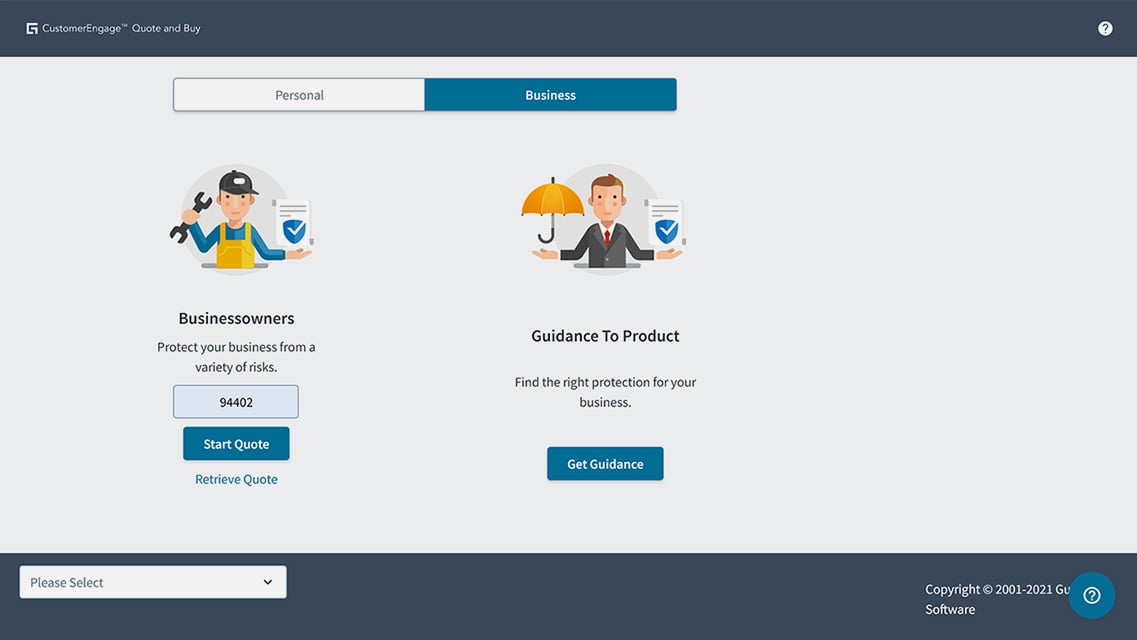

User Interface:

- Navigating and utilizing the Policy Center user interface.

- Customizing the interface to meet specific business needs.

Policy Lifecycle Management:

- Creating, modifying, and renewing policies.

- Handling endorsements and cancellations.

Business Rules:

- Implementing and managing business rules to automate processes.

- Ensuring compliance with regulatory requirements.

Reporting and Analytics:

- Generating reports and utilizing analytics features.

- Extracting meaningful insights from policy data.

Testing and Troubleshooting:

- Conducting testing procedures to ensure system reliability.

- Troubleshooting common issues and errors.

Core Components of Guidewire Policy Center:

Policy Data Model:

- Defines the structure and relationships of policy-related data.

Product Model:

- Represents the various insurance products offered by the company.

Rules Engine:

- Governs the implementation of business rules and underwriting guidelines.

Workflow Engine:

- Manages the flow of tasks and processes throughout the policy lifecycle.

User Interface:

- Provides a user-friendly interface for policy administration.

Integration Layer:

- Facilitates seamless integration with other Guidewire modules and external systems.

Career Benefits of Guidewire Policy Center Training:

In-Demand Skills:

- Training in Guidewire Policy Center equips professionals with skills that are in high demand in the insurance technology sector.

Industry Relevance:

- Knowledge of Guidewire Policy Center makes individuals valuable contributors to insurance companies aiming to modernize their policy administration processes.

Career Versatility:

- Graduates of Guidewire Policy Center training can pursue roles in configuration, integration, testing, and more, offering a versatile career path.

Competitive Edge:

- Certification in Guidewire Policy Center provides a competitive edge in the job market, demonstrating expertise in a widely used insurance technology.

Opportunities for Advancement:

- Individuals with Guidewire Policy Center expertise may advance to roles such as consultants, architects, or project managers, leading to increased responsibilities and higher positions.

Global Opportunities:

- Guidewire is a globally recognized platform, opening doors to career opportunities across various regions and international insurance markets.

Contribution to Industry Innovation:

- Professionals trained in Guidewire Policy Center play a crucial role in driving innovation within the insurance industry by implementing advanced policy administration solutions.

Write a public review