Delve into the heart of Guidewire Policy Center's functionalities with our Comprehensive Functional Mastery Course. This program provides a deep understanding of policy lifecycle management, covering key areas such as policy creation, underwriting, endorsements, renewals, and advanced configuration techniques. Real-world scenarios are explored, enabling practical application and refining problem-solving abilities. Additionally, participants enhance their reporting and analytics skills and gain insights into collaborating on integration strategies with other modules and external systems.

The Guidewire PolicyCenter certification training course includes below:

Course Introduction: An overview of the certification program, the training objectives, and the structure of the course.

PolicyCenter Overview: A detailed introduction to Guidewire PolicyCenter, its features, architecture, and the role it plays in insurance policy administration.

PolicyCenter Configuration: Hands-on training on configuring PolicyCenter to meet specific business requirements. This may include setting up lines of business, products, rules, workflows, and user roles.

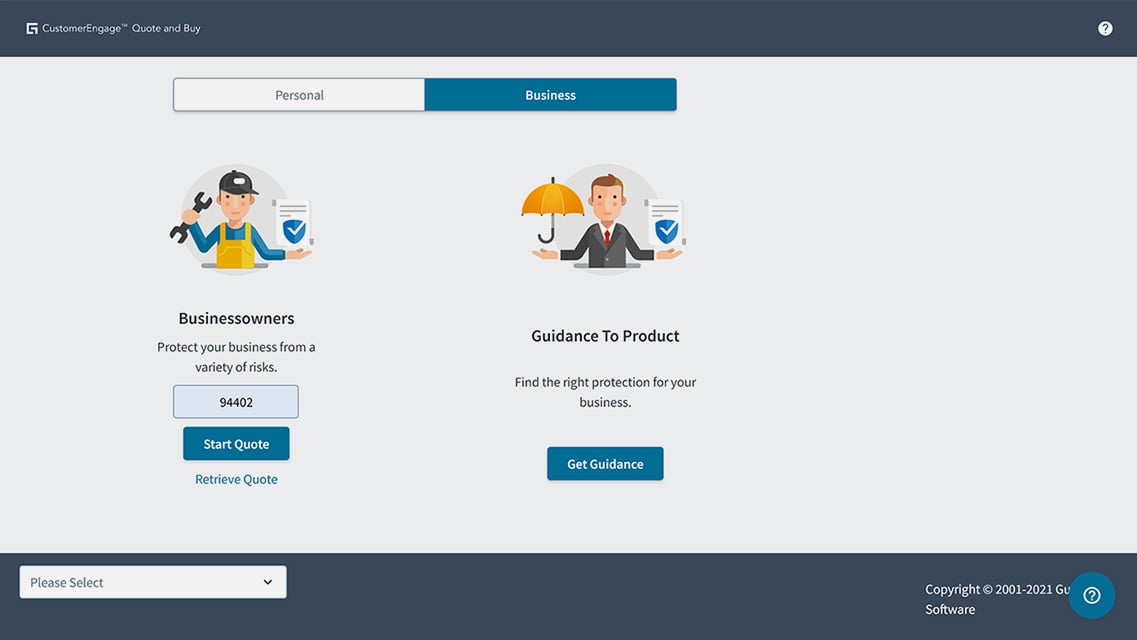

PolicyCenter Integration: Instruction on integrating PolicyCenter with other systems such as billing, claims, and external data sources. This may involve learning about integration patterns, web services, and data mapping.

PolicyCenter Functionality: In-depth training on various PolicyCenter functionalities, including policy quoting, underwriting, rating, endorsements, renewals, cancellations, and endorsements.

PolicyCenter Customization: Guidance on extending PolicyCenter's capabilities through customizations. This may cover topics like creating custom screens, data model extensions, and business rules.

PolicyCenter Testing and Troubleshooting: Techniques for testing PolicyCenter configurations, workflows, and integrations. Instruction on troubleshooting common issues and resolving them effectively.

Certification Exam Preparation: Review of the key concepts covered in the course and practice exams to help you prepare for the certification exam.

Certification Exam: A final exam to assess your understanding of PolicyCenter and determine your eligibility for certification.

Key Learning Objectives:

Master Policy Creation and Underwriting: Develop expertise in crafting policies and navigating the underwriting process within Guidewire Policy Center.

Navigate Endorsements and Renewals with Precision: Learn to adeptly handle policy endorsements and renewals, gaining a comprehensive understanding of the entire policy lifecycle.

Unlock Advanced Configuration Techniques: Dive into the advanced configuration features of Guidewire Policy Center, enabling customization aligned with specific business needs.

Optimize Policy Management Functionalities: Gain proficiency in utilizing various functionalities within Guidewire Policy Center to streamline and enhance policy management processes.

Apply Knowledge to Real-world Scenarios: Exercise acquired knowledge in real-world policy scenarios, refining problem-solving skills specific to insurance policy management challenges.

Enhance Reporting and Analytics Skills: Explore reporting and analytics functionalities within Guidewire Policy Center, extracting meaningful insights for informed decision-making.

Collaborate on Integration Strategies: Gain insights into integrating Guidewire Policy Center with other modules and external systems to create a seamless workflow.

Write a public review